Carbon Tax Projections for Malaysia

- Gregers Reimann

- Mar 10, 2022

- 2 min read

Updated: Apr 18, 2022

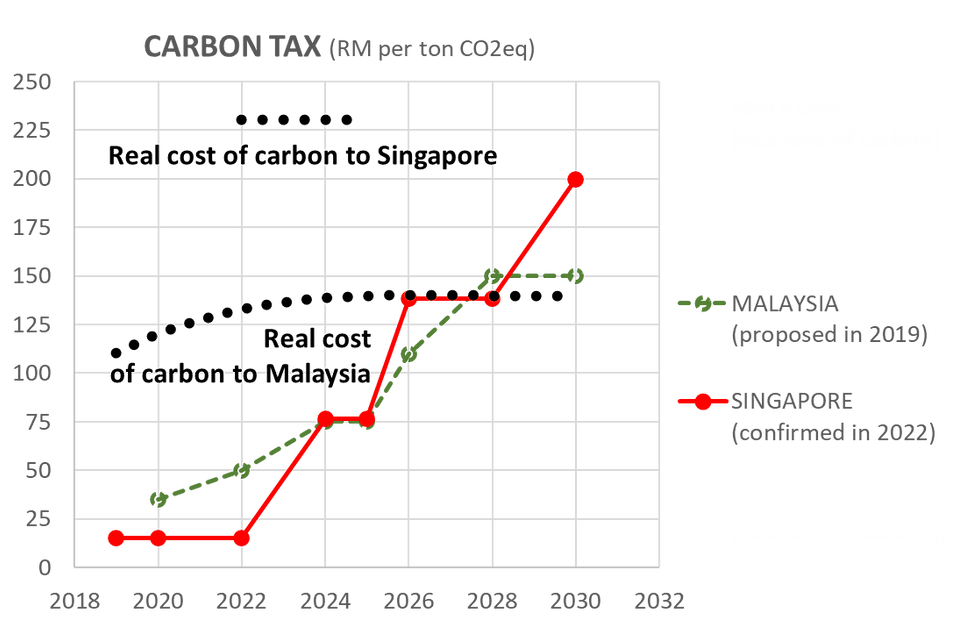

A 10-fold increase in the carbon tax over the next ten years was recently announced by the Singapore government. Notably, Singapore was the first country in South-East Asia to introduce a carbon tax in 2019. The question is, will Malaysia and other countries follow? And are the proposed carbon tax rates high enough?

The graph shows that even though Singapore plans to drastically ramp up its carbon tax, by 2030 it still falls short of the polluters pay principle, as Singapore's social cost of carbon (SSC) at RM230 per ton CO2eq exceeds the proposed carbon tax. In the case of Malaysia, which currently has no carbon tax in place, one many refer to the recommendations of a detailed carbon tax study published by the Penang Institute that recommends a gradual ramping up of the carbon tax to RM150 per ton CO2eq by 2028, which would match the social cost of carbon in Malaysia. Interestingly, the study showed carbon taxation could be introduced without financially burdening the low income segment of the population through the mechanism of targeted subsidies.

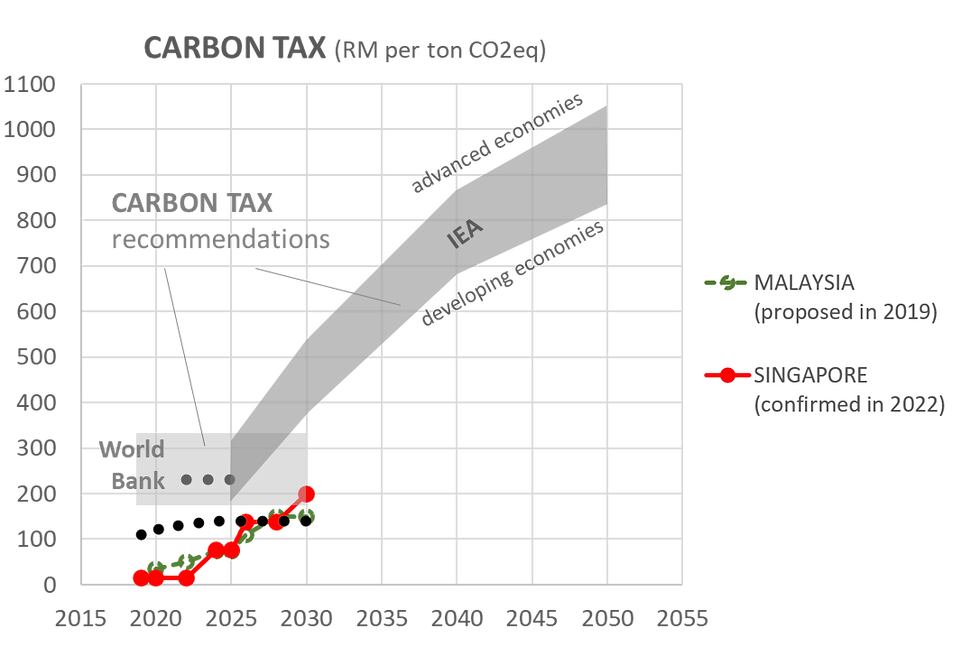

Looking towards 2050, by which time most developed nations have pledged to achieve zero carbon emissions, the International Energy Agency (IEA) has recommended the following ramping up of carbon taxation rates:

At first glance, the above carbon taxation rates might seem excessive or even radical. However, when one realises that the World is on the brink of irreversible climate change crisis that poses an existential threat to humanity, and that business-as-usual carbon emissions from fossil fuels are the root cause of the climate catastrophe, it becomes clear that the decision of not taxing carbon pollution is the radical position - and not the other way around.

In other words, we should all get ready for the implementation of substantial carbon taxation - and the sooner it happens, the better. Otherwise, we have to answer to our kids, grandkids and future generations. Or as the UN Secretary-General, Antonio Guterres, put it last week: "The abdication of [climate] leadership is criminal"

The above article was slightly rewritten also to include the EU's carbon border adjustment mechanism (CBAM), and was published in the @green magazine March-April 2022 issue; read or download pdf article below:

The entire @green magazine is available for free online here: https://viewer.joomag.com/green-march-april-2022/0086755001650109702

Sources:

Comments